If profit = revenue – expenses, then we can modify our formula one last time: Now, this is important because Retained Earnings are simply profits earned by the business. Assets = Liabilities + Owner’s Investment + Retained Earnings.I’ll re-write the equation one more time: Then, intuitively, retained earnings are just the profits not distributed back to the owners (through dividends)… or all of the money the business has made and reinvested in itself over time. We could also think of it as the “Owner’s Investment”, money put in as an investment into the business in order for an ownership claim on future profits. So now we should understand the “Available Capital” represents the ownership stake in (and claims to) the business. In a successful IPO, direct investors might pay over par because of the potential they see with the company. Note: Additional paid-in capital, or APIC, is the amount paid for shares over par by an investor buying directly from the company. Treasury stock – the shares that the company has repurchased.

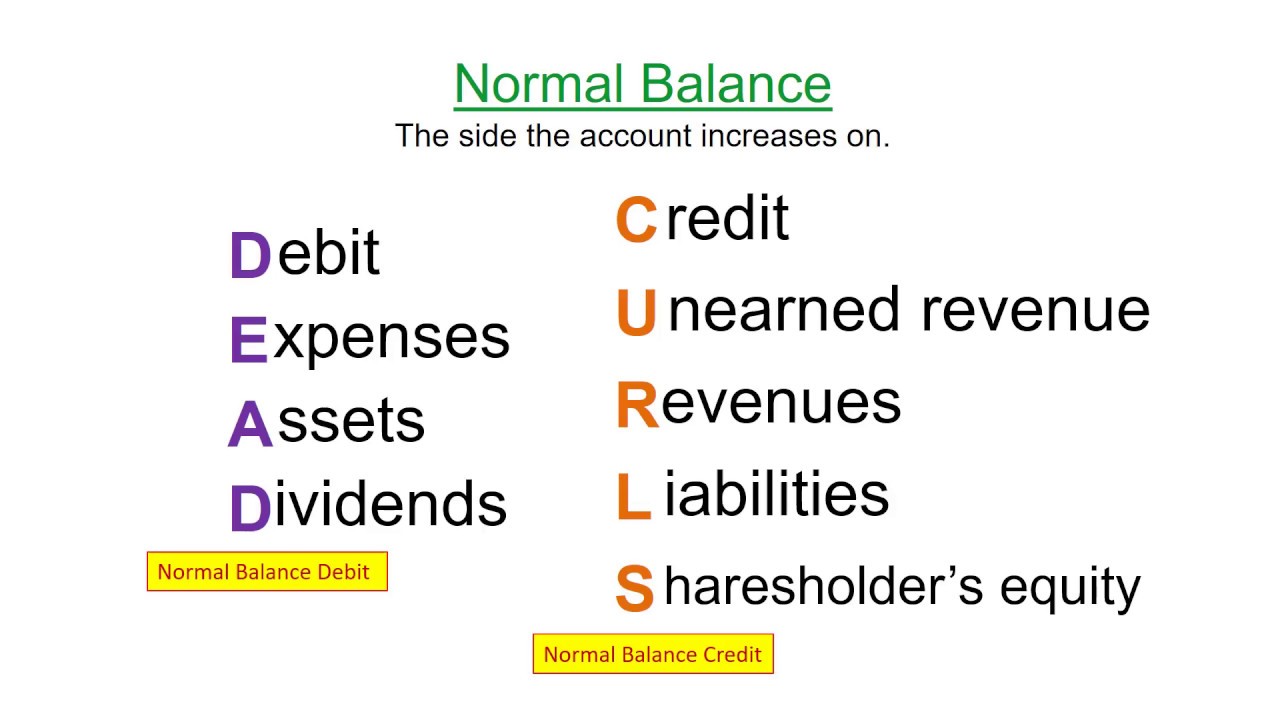

Additional paid-in capital – think of this as the “profit” the company made from the IPO.Outstanding shares – think of this like the number of shares sold in an IPO.Now, “available capital” can be thought to encompass the following 3 components of Shareholder’s Equity (the fourth being Retained Earnings): Assets = Liabilities + Available Capital + Retained Earnings.Assets = Liabilities + Shareholders’ Equity.We can further expound on this equation, and apply what we’re more familiar with regarding financial accounting of public companies, as: The 5 groups are created from the building block equation of accounting: There’s 5 account groups of accounting, with 2 having “backwards” treatment of credits vs debits, and 3 having more intuitive treatment of credits vs debits. The Basics of Accounting (5 Account Types) That’s right, which is why we have to go back to the basics of accounting in order to understand how deferred revenue flows through the financials. Wait… But you just defined a credit and a debit as the same thing! Recognizing revenue will debit (decrease) deferred revenue account and credit (increase) revenue in the income statement.Deferred revenue converted to revenues as these services are delivered.Creates a credit (increase) to liabilities (deferred revenue).Creates a debit (increase) to assets (cash).Recorded as liability on the balance sheet.The life of Deferred Revenue in Financial Statementsįirst off, deferred revenue and unearned revenue are ultimately the same thing-essentially, prepayment for goods or services yet to be delivered. Let’s summarize, and then mastermind (hypothetically, of course). Hopefully by now we understand the reasons why thoughtful analysis of deferred revenue is a very worthwhile use of our time. Any doubt about the sustainability of revenue throws the rest of the financial model into question”.Īccounting is of such critical importance, that billionaire Charlie Munger suggested that for his partner Warren Buffett, understanding accounting to him was akin to breathing.Įven famed entrepreneur Phil Knight, the founder of Nike, cut his teeth as an accountant and had the lesson of “equity, equity, equity” drilled into his head as he ran his first company.ĭeferred revenue and its function in the financial statements can be a major source of aggressive revenue recognition with companies (especially service or subscription based ones), which can lead to short term profitability jolts, which at the same time cripple future profitability. “Because the rest of the financials depend on revenue, it deserves the most scrutiny. Of course, we should know that understanding the intricacies behind deferred revenue is of critical importance for financial statement analysis.Īs author John Del Vecchio, CFA said in his great book What’s Behind the Numbers: Basic accounting for public companies can get confusing with different terms that mean the same thing (like deferred and unearned revenue), vs opaque definitions (such as recording a debit or credit on deferred revenues, assets, or expenses).

0 kommentar(er)

0 kommentar(er)